michigan unemployment income tax refund

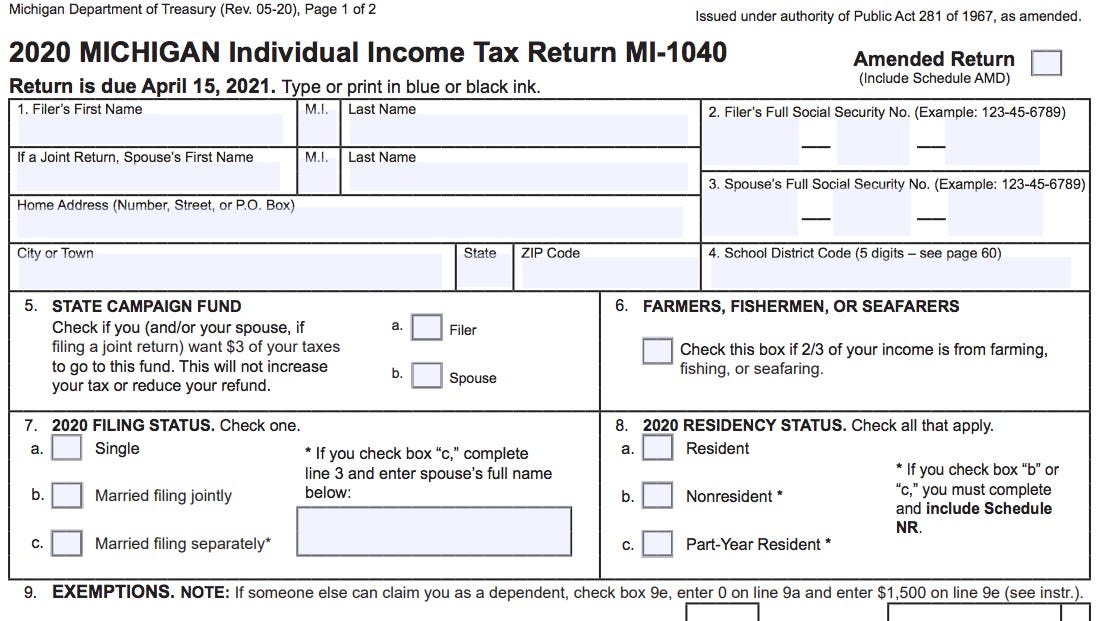

You pay tax in your home state only. For taxpayers filing Part-Year Michigan Individual Income Tax Return MI-1040 how is the federal.

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break.

. Use the MI-1040 and check the amended box. When you create a MILogin account you are only required to answer the verification questions one. Instructions included on form.

If you use Account Services select My Return Status once you have logged in. Before starting this process please select the appropriate option below. 2020 Home Heating Credit MI-1040CR-7 Alternate Credit Computation.

Michigan Business Tax 2019 MBT Forms. 2856Book Guidelines for the Michigan Homeowners Principal Residence Exemption Program no form NA. Allow 6 weeks before checking for information.

This Notice is an update to the Notice published April 1 2021 and provides guidance to taxpayers. Unemployment income is allocated to the state of residence at the time of receipt. Please allow the appropriate time to pass before checking your refund status.

You may check the status of your refund using self-service. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes. Say Thanks by clicking the thumb icon in a post.

By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state and federal criminal prosecution and penalties as well as civil penalties. Michigan unemployment income tax refund Sunday May 22 2022 Edit. Michigan Homestead Property Tax Credits for Separated or Divorced Taxpayers.

In the latest batch of refunds announced in November however the average was 1189. I wish to take the Michigan Identity Confirmation. Instructions included on.

The creditor must also serve a copy of the writ on you. Certain unemployment compensation debts owed to a state generally these are debts for 1 compensation paid due to fraud or 2 contributions owing to a state fund that werent paid. Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. People are filing their tax refunds and because things are clogged up for some of those people those can be garnished said Lisa Ruby a Michigan Poverty Law Program attorney. This system contains US.

Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Composite Individual Income Tax Return.

If a creditor has a judgment against you and wants to garnish your tax refund it must file a Request and Writ for Garnishment with the court. Mark the post that answers your question by. Include schedule AMD which captures the reason why you are amending the return.

Without the 1099 workers are forced to make a choice between filing their tax returns without the 1099 and filing an amended one later which the US Treasury frowns upon or waiting and filing after they receive it Lisa Ruby public benefits attorney at the Michigan Poverty Law Clinic which advocates for low-income residents told. Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. Then the creditor must file the writ with the Department of Treasury.

Account Services or Guest Services. Mortgage Foreclosure or Home Repossession and Your Michigan Individual Income Tax Return. For the federal income tax return total unemployment compensation is reported on Line 7 of federal Form 1040 Schedule 1.

2020 Home Heating Credit MI-1040CR-7 Standard Allowance. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Home Heating Credit And Shared Housing Situations.

State income tax obligations. President Bidens recent federal American Rescue Plan Act excludes unemployment benefits of up to 10200 from income in the 2020 tax year for taxpayers falling. Garnishment of State Tax Refund by Other Creditors.

The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020. You received a letter from the Michigan Department of Treasury directing you to this web site to confirm your identity or identify the return as suspicious. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. There are two options to access your account information. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

Instructions included on form. Include all forms and schedules previously filed with your original return. This threshold applies to all filing statuses and it doesnt double to 300000 if you were married and file a joint return.

I filed a tax return I had a tax return filed on my behalf. City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes City Business and Fiduciary Taxes Employer Withholding Tax. To complete properly check Box N and on line 8 Explanation of changes please write Federal Unemployment Exclusion.

If a taxpayer is a part-year Michigan resident the federal unemployment income exclusion is prorated over the same period as the unemployment income. Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment Income Tax Season 2022 What To Know Before Filing In. You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset.

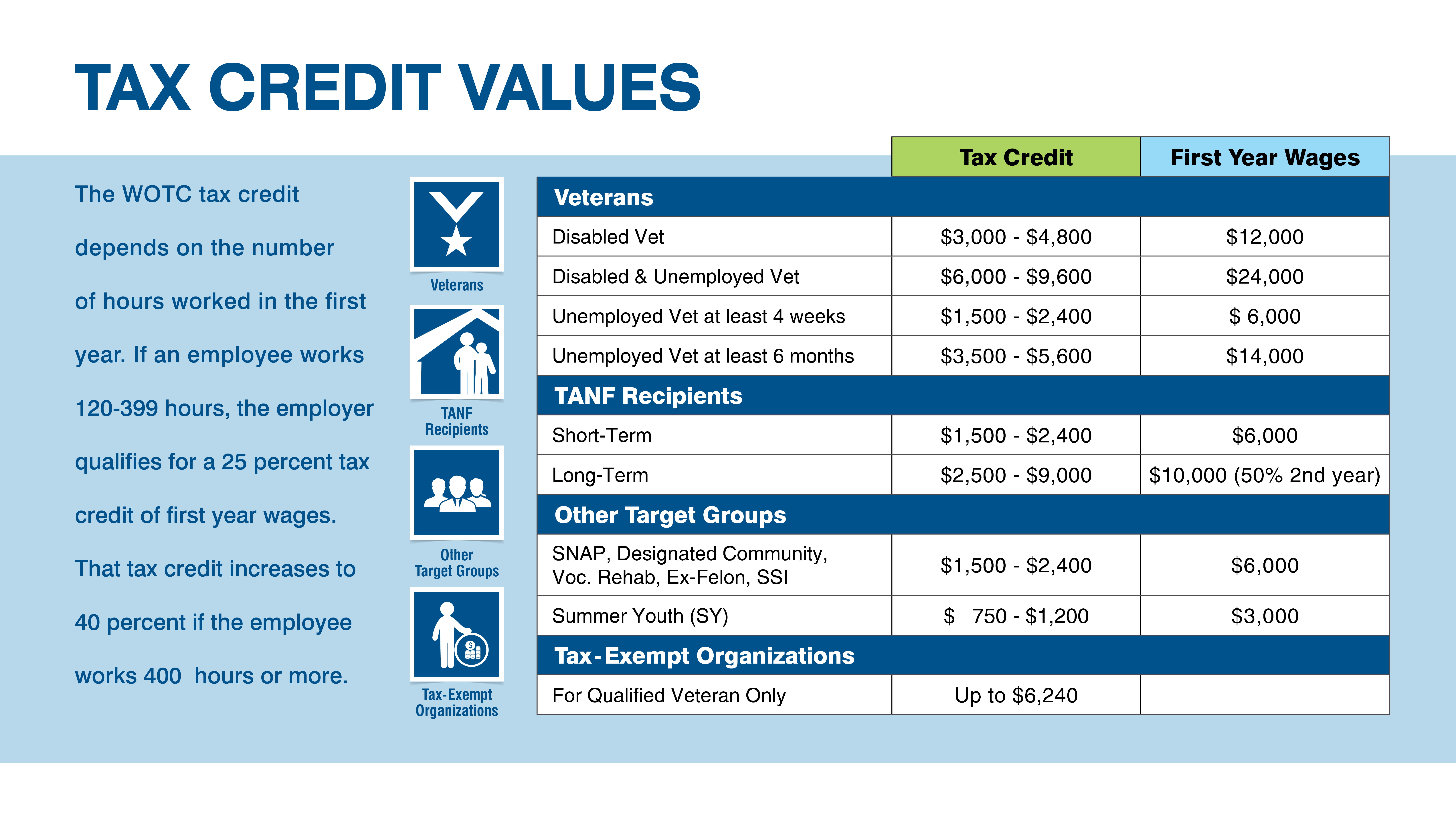

Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. The rule change only applies for 2020 tax must be.

See How Long It Could Take Your 2021 State Tax Refund. Adjusted Gross Income AGI or Total Household. Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment.

The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. Direct Deposit of Refund. But even as workers await the document the state has yet to decide whether thousands of jobless workers will have to repay up.

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Leo How To Request Your 1099 G

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Michigan Pauses Debt Collection From Unemployment Mistake Weyi

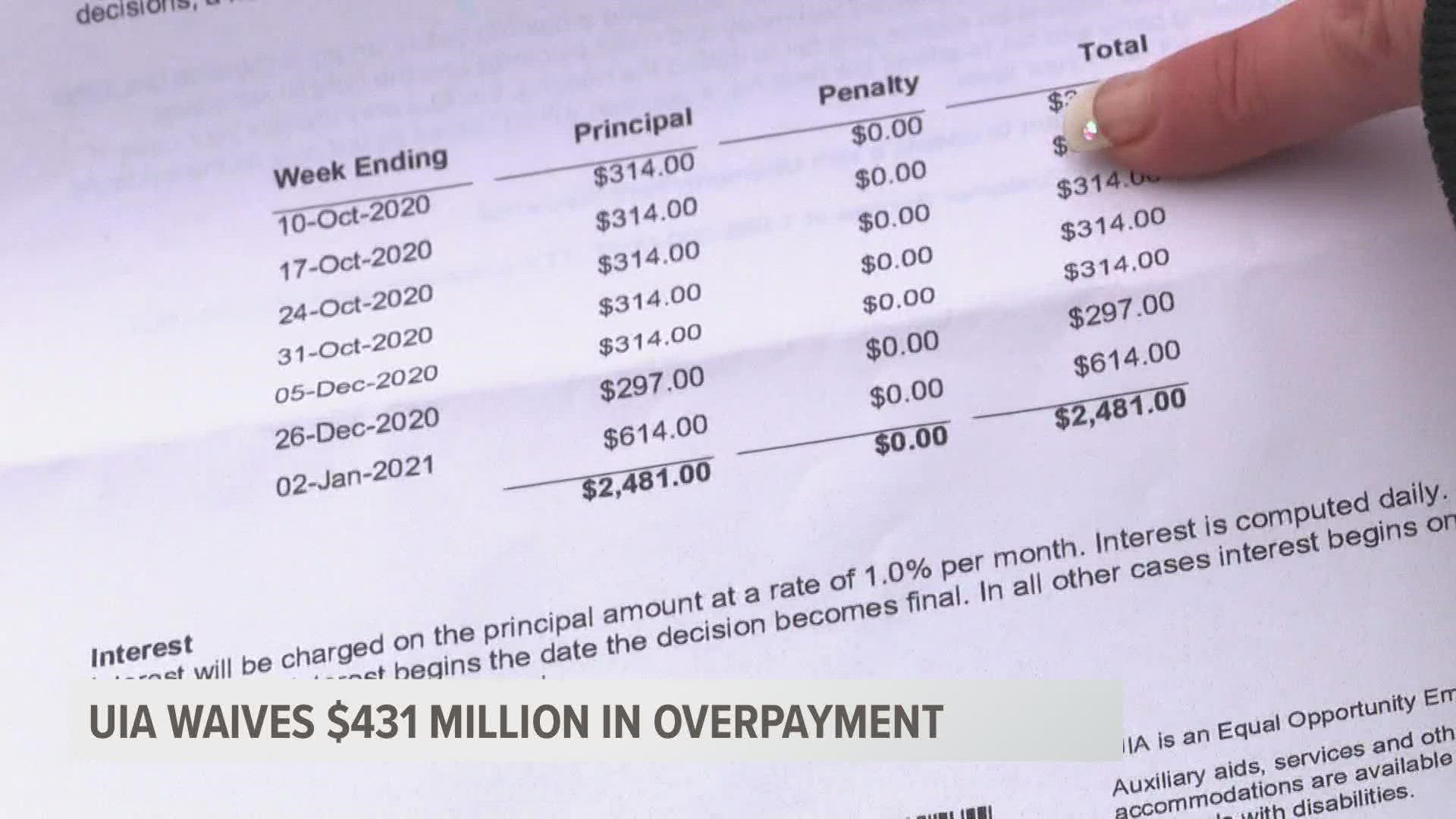

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Where S My Refund Michigan H R Block

Michigan Unemployment Agency Overpaid 3 9 Billion In Benefits Audit Says

Leo Work Opportunity Tax Credit

We Are An Authorized Irs E File Provider Call Us Today To Get Your Taxes Prepared And Your Refund Asap 40 Certified Public Accountant Tax Lawyer Tax Services

State Of Michigan Taxes H R Block

Income Tax Season 2022 What To Know Before Filing In Michigan

State Pushes Back Release Of Unemployment Aid Tax Forms

Pin By Hr Service Inc On B3pa Social Media Marketing Life Is Short

Michigan Uia Waives 431 Million In Overpayments Wzzm13 Com

Michigan Income Tax Garnishment Acclaim Legal Services

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

1099 G Tax Statements Now Viewable For Michiganders

Feds Relax Rules For Workers Ordered To Repay Michigan Unemployment Benefits Bridge Michigan

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com